TL;DR: With a new update or project being released almost every day, it’s clear the crypto ecosystem is constantly evolving. Tron has gone through a lot of ups and downs to reach the level it’s at today — but it’s just the beginning. Knowing what brought it here and why it was created will lead you to make better decisions when investing or simply using Tron.

In this article, we’re gonna dive into the Tron ecosystem, answer all the $TRON related questions and even more. Prepare yourself for a history lesson and a journey to the future of Tron!

What is Tron (TRON)?

Tron is a Layer 1 blockchain created in 2017 by Justin Sun. It is a smart contract platform that focuses on being highly scalable.

TRON started out as a literal fork of the Ethereum protocol. Ethereum has been created in 2014 and introduced the concepts of smart contracts. These are small applications that run inside a virtual machine called the Ethereum Virtual Machine. The EVM allows for a blockchain to process more than simple token transfers.

To give more info, it opened up the possibility to run applications in a decentralized manner. Applications usually run in the cloud or on your computer, so running them on a blockchain was unheard of at the time. This makes them uncensorable (nobody can stop them) and ensures they’re always online — as long as the chain they run on is processing transactions. TRON uses the same EVM as Ethereum.

Eventually, TRON migrated to its own mainnet in 2018, but it still follows the development happening on Ethereum. Being so similar to Ethereum, deploying on TRON is as easy as copying and pasting the code. Furthermore, the implementation should leave room for TRON to catch up with further Ethereum upgrades. While similar to Ethereum, it implements a some new improvements to the protocol.

In order to be highly scalable, Binance had to take shortcuts in designing its blockchain. One of the crucial decisions early on was to implement the Delegated Proof of Stake consensus algorithm. Proof of Stake means that TRON gets its security from validators that stake $TRON to secure the chain. Delegated Proof of Stake requires users of the network vote and elect delegates to validate the next block.

A limited number of delegates (most protocols choose between 20 and 100) are chosen for each new block. Elected delegates receive the transaction fees from the validated block, and that reward is then shared with users who pooled their tokens in the successful delegate’s pool.

The concept of blockchains is not new, and TRON is one of many such networks. The idea started in 2008 with the release of Satoshi Nakamoto’s Bitcoin Whitepaper. This kicked off the subsequent creation of many different types of networks under the same “blockchain” terminology.

Despite being similar in concept blockchains have all different architectures and use cases. What all have in common — including TRON — is that they have to be secure. Security is the ability of a blockchain to prevent attacks and penalize malicious actors. This is usually done through their consensus algorithm and the mechanism they use to reach finality.

Finality is achieved when a block has been created and is now immutable, meaning that nobody can change the date inside. The block finality on TRON is 3 seconds, compared to Ethereum’s 12 seconds.

Over time many different mechanism have been designed, ranging from Proof of Work, Proof of Stake to novel ones called Proof of Spacetime. Each one hopes to achieve the best way of securing the network they are built for. As noted before, TRON makes use of type of consensus mechanism we call “Delegated Proof of Stake” — or DPoS for short.

One particularity of Delegated Proof of Stake is that validators are incentivized to act honestly as they do not wish to have their identities attached to a negative reputation. Currently TRON has 27 active validators.

Similarly to Ethereum, slashing mechanisms have been implemented to ensure security, stability, and finality. Slashing ensures that validators abide by the protocol rules, or risk losing a portion of their staked tokens. There is no surprise that with its current design, TRON is heavily centralized, as the top 27 validators almost never change.

The Delegated Proof of Stake consensus mechanism was chosen to enhance block times and lower transaction costs. Despite its centralization, many users would flock to TRON to avoid the costly fees on Ethereum.

TRON has a booming ecosystem that grows daily, all powered by its native token. The native token of TRON is used actively throughout the network, from validators to users. Besides $TRON, developers can create their own TRC native tokens similar to Ethereum.

ERC-20 standards were introduced in 2015 and are the most common Ethereum standard currently being used. It is mostly used for the creation of fungible tokens on the network. Borrowing from Ethereum’s design, Binance created its own equivalent of Ethereum’s ERC-20 token standard.

Today, TRC-20 is widely used for any project deploying on TRON, from DeFi projects to meme tokens. It is fully compatible with ERC-20 and gives developers similar flexibility that they enjoy on the ERC-20 standard.

TRON is an inflationary token due to the way its tokenomics have been planned. This means that new TRON coins are created with each block and the circulating supply continues to expand. The Tron inflation rate sits currently at around 2%. TRON has no maximum amount of tokens that can be created.

For more details about how you can earn more Tron by running a validator node at home check out our Tron Mining & Staking guide. It includes the exact steps and best methods of earning more crypto like $TRON in 2024 and beyond.

When was Tron (TRON) created?

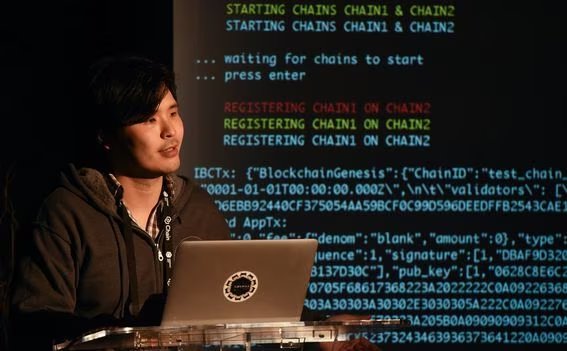

Tron (TRON) was created during Justin Sun’s academic journey at Hupan University. Work began on the Tron chain in 2017, but before that, a couple of important events happened. Most events revolve around the Tron CEO and Founder, Justin Sun.

The first meaningful event was Justin’s first encounter with the concept of crypto. It was in 2012 when Justin stumbled upon Bitcoin while surfing the internet. Since he was in college, Sun made a reputation for criticizing the socialist values of China. It was easy to see why he clicked with idea behind Bitcoin. The network is decentralized, secure, and enables peer-to-peer payments. Seeing the oppression happening in his country, Sun made up his mind to invest and understand the technology.

In the same year, Sun began investing large amounts of his college tuition fees into bitcoin. His student life was going well, causing troubles but still being a good student. While studying for his Master at the University of Pennsylvania, Sun continued to invest in Bitcoin and study the technology. Outside crypto, he was spending time reading history and writing. He initially believed that the secrets of social progress lay in the minds of historians and writers. Upon deeper reflection he decided that he needed to become an entrepreneur if he wanted to change the world.

Upon graduation in 2013, before officially entering the blockchain space as a crypto founder, Justin’s first job was working for Ripple Labs based in Silicon Valley. Ripple is described by Sun as “a decentralized payment system supported by the value of the network, which allows different currencies to exchange freely and with zero delays.” Sun eventually became the head of Ripple China. Ripple was a great introduction for Justin to the world of decentralization and the tech world of the United States.

The second meaningful event is related to the ICO mania from 2017. Initial coin offerings, or ICOs, are a popular fundraising mechanism where participants contribute with money and receive tokens of a blockchain project in exchange.

The concept is similar with the fundraising platforms such as GoFundMe or Kickstarter, but it introduces a couple features.

The first one is offering contributors a share of the project’s value. Tokens had real value and could be traded on exchanges for assets like BTC or ETH. Unlike traditional funding campaigns, where contributors were promised future products or discounts, ICO participants were handed shares of the project. This brings token sales closer to the idea of an IPO.

The second one is that participation was open to anyone. In other words, it didn’t matter if you were a regular person, or an accredited investor. The only condition was to have some crypto in order to contribute to the token sale. The open nature of ICOs made it simple to raise millions of dollars for just an idea. And this is exactly what happened. Projects started using buzzwords such as “decentralized,” “artificial intelligence,” “revolutionary,” “democratizing,” in their whitepapers. People who had little technical knowledge really believed that they were part of a world a world changing movement.

ICOs were possible thanks to smart contracts, which were created by Ethereum. Using a piece of code, developers are able to create autonomous software. Commands are executed by the code itself rather than a person. Without a centralized custodian, ICO participants were sending money to a smart contract, which then distributed tokens based on a set of predetermined rules. It took months and millions in losses before the regulators realized that ICOs were selling unregistered securities.

2017 was a fuzzy year in terms of regulations. Governments were taken by surprise as they watched how millions of dollars were exiting their country towards these projects. In a knee jerk reaction, they rushed to ban ICOs. But their action was too slow to stop the bleeding.

On the good side, some of the projects we see today started out with an ICO. Examples include Binance, Filecoin, Tezos, and The DAO. If it weren’t for the community’s engagement, the crypto scene of today would have looked much more different.

Having grasped the concept of blockchain, Justin Sun saw a window of opportunity to come up with his own project, TRON. Back then, copies of Ethereum were very popular. Tron made no exception.

Justin Sun literally forked the Ethereum code and made a couple adjustments to make it more scalable. He then leveraged his public image in China to advertise TRON to millions of people. The project managed to differentiate itself by targeting the Asian market. Later on, Justin Sun founded Tron Foundation and launched the $TRON token. The $TRON token was sold only through a public sale that netted a whopping 58 million. Such a huge investment has allowed Tron to continue building the vision of a decentralized internet.

There was a big problem though. Right before TRON’s token sale was about to being, China banned ICOs. Justin Sun proceeded with the token sale anyway and arranged his getaway from China. Sun’s route of escape is shrouded in mystery. He eventually made it to the United States, where he was safe from China’s government reach.

Who created Tron (TRON)?

Tron was created by Justin Sun after discovering the opportunities presented by the blockchain industry. Today, he is regarded as a crypto mogul, with a net worth estimated at $3 billion. Let’s see how his story came to be!

Justin Sun is a 32 year-old entrepreneur born in China. He studied at the Peking University, Beijing, between 2007 and 2011 where he graduated with a Bachelor’s of Arts, History. In the following years, he completed his Master in Political Economy at the University of Pennsylvania.

One of his first entrepreneurial endeavors was a voice-streaming app called Peiwo. Aimed at millennials in China, Peiwo connects like-minded users via live audio chats based on a 10-second voice sample provided by users. The app is said to have matched more than four billion chats.

At the end of 2013, Sun became a representative of the Bitcoin settlement platform, Ripple, in China. Although his stay at the company was short, Sun gained knowledge about crypto and understood how the blockchain business works.

After founding Peiwo, Justin Sun was invited by Yu Jianjun, a Hupan University alumni and co-founder of the Chinese audio streaming company, Ximalaya FM, to share his story as a successful young entrepreneur. The interview gained popularity, with the show having more than 7.5 million plays. Sun shared his personal experiences in wealth management and industry insights, and interacted with his followers who sought financial or career advice.

In 2015, famous Alibaba founder, Jack Ma, started Hupan University, in Hangzhou, and Justin Sun was one of the 30 students who had the potential to change the landscape of China’s business world. The day he stepped in the university, Sun knew deep down inside that the experience would change his life forever. Despite being the youngest student, he made up for his lack of experience with sheer determination and ethic.

Sun graduated from Hupan University in 2018 after finishing the three-year programme and submitting a thesis titled The Birth of a Decentralized Internet, focused on the blockchain industry – an area few of his peers attempted to research.

A year prior to graduation, he decided to take his chances with a blockchain project called TRON. The idea of the project wasn’t exactly groundbreaking. Many others were trying to build a “decentralized internet.” Moreover, the blockchain was a literal clone of Ethereum.

In 2018, TRON left Ethereum to build its mainnet. The network had over 3 million holders with a market cap of $2.5 billion.

How is the Tron (TRON) token used?

The TRON token is the native token for the Tron network. Most assets in the TRON ecosystem are denominated in TRON, which makes it the default unit of account.

TRON is the fuel that powers transactions and block creation on the TRON chain. We sometimes refer to it as “gas.” Its primary use case is securing the network and keeping actors aligned to the same principles. Because Tron has a quick time to finality and processes more transactions per second the gas fees quickly add up. This small fee is paid by users and goes to validators for doing their work.

NEAR is currently listed on multiple exchanges. The major ones are Binance, Coinbase and Kraken. If you want to skip ahead and learn how to earn more Tron by running a validator node at home check out our Tron Mining & Staking guide. It includes the exact steps and best methods of earning more crypto like $TRON in 2022 and beyond.