TL;DR: Cryptocurrency is a life changing opportunity for many people that get in early and know what they’re doing. It’s happening with STX and it will happen with other tokens on Stacks as well.

It’s safe to say the crypto industry is still in its infancy with gigantic room left to grow. Stacks crypto tokens might be quite a good investment, but you have to know how to asses the status of the STX network and its future value.

In this article, we’re gonna learn how to judge the economics of a blockchain such as Stacks and draw a conclusion based on it.

Should you buy Stacks (STX)?

With a total predicted market cap of $15 trillion by 2025, crypto investing is clearly on the rise. Over the past few years the crypto industry has maturated from “magic internet money” into fully fledged companies that are on their way to become major financial institutions.

From the 40 year old Bitcoin maxi to the 15 year old who flips JPEGs as a side hustle, putting some money in novel technologies such as cryptocurrencies is now a trending activity for investors of all ages. The new generation didn’t get their shot at investing in the tech giants of today, and crypto is seen as the next big technological revolution.

Why is that you ask? To put it short, traditional assets have reached their explosive peak. Digital assets such as tokens, coins, and NFTs are a new financial instrument that you can use to better diversify your investing portfolio.

Tired of small returns people are shifting their attention to more compelling assets — but that also comes with several downsides. Navigating these downsides and preparing yourself for what to expect when buying tokens is a crucial part of investing. Knowing all the intricacies is not always necessary but some knowledge is required to not blow up your account by investing in crypto.

Stacks is a cryptocurrency and as any other cryptocurrency, it’s prone to volatility. After seeing the performance of the Stacks chain it’s understandable to ask yourself if STX is a good buy right now.

Buying its native STX token is one of the possible ways of making money on Stacks, but is it worth it? What does STX do and is Stacks the future?

A clear answer to these 2 questions is needed before allocating a part of your portfolio to $STX.

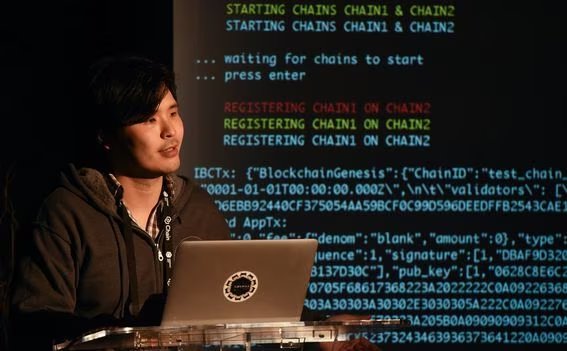

Launched in 2019, Stacks aims to solve one of Bitcoin’s biggest shortcomings: the lack of smart contract functionality. At its core, Bitcoin represents an elemental blockchain, hence its security and durability.

Stacks connects Bitcoin to enable apps and smart contracts on its blockchain. Why would an app want to connect to Bitcoin? Because Bitcoin is the most secure blockchain. This is why Stacks is offering a suite of solutions for developers to bridge the gap between Bitcoin and the rest of the crypto apps.

By introducing smart contracts to Bitcoin, Stacks can provide new use cases for Bitcoin such as BTC-backed loans, bitcoin DeFi and using your BTC to trade NFTs. The idea is catching on with the community as dozens of dapps have been deployed on Stacks.

Why does Stacks (STX) have value?

The STX token is named as “the common unit of account” of the Stacks ecosystem.

In simple terms, STX is the native token for the Stacks blockchain. It is used throughout the ecosystem and has many use cases.

Stacks is the network (also called blockchain), and the $STX token is the fuel that powers it. Every interaction on the Stacks chain requires users to pay a small fee, called gas fee. The gas fee is paid to miners & validators in exchange for securing the network.

Having no fees or a fee that is too low opens up the network to attacks and spam transactions. Blockchains work on the premise that attacks should be very expensive. If the fee is cheap attackers can spam transactions and clog the network. This is the case we’ve seen with blockchains such as Solana.

In the instance of Stacks, its native STX token is used by both validators and users. Both of these network members (or “actors”) need $STX for different purposes. This creates an economic structure that is healthy for the future of the STX token.

Validators need to stake $STX to confirm transactions and produce new blocks. Such a rule is implemented so that malicious validators can get sanctioned if they try to attack the network. Being stable and immutable at all times are the primary scopes of a blockchain, everything else comes second. If a validator tries to include a bad transaction in a block then its stake is cut — a concept known as “slashing”.

Using the Stacks blockchain also requires some STX, regardless of the type of transaction being sent. Users pay a small fee in STX to validators for verifying and including their transaction in a block.

Stacks’s Proof of Transfer consensus mechanism requires STX tokens to be used as a measure for preventing bad behavior. Without it, users cannot make transactions and validators cannot join the network. With this in mind we can conclude that the main use case of the $STX token is securing the Stacks blockchain.

Can the usage of the network affect the price of Stacks (STX) tokens?

As more people join the network and use Dapps on Stacks it impacts the dollar amount that new buyers will have to pay when buying STX coins. If more users join the network, that puts economic pressure on the supply of the STX token. A bigger number of people will need to buy STX tokens — making the price of Stacks go up as more people use the chain and the dapps on it.

This also has an effect on the actors that validate the transactions users make on the network. More people means more transactions, and more transactions means more fees.

So the more people use the network, the higher the revenue for all validators becomes. As the revenue grows, more validators join the network, buying and staking STX tokens to participate.

This correlation between network usage and the value of the native token is a natural occurrence in Proof of Stake blockchains such as Stacks. It is also what gives the STX token its primary monetary value. How high that value can be is detailed in the next sections.

Why is Stacks (STX) going up/down?

Stacks, like any other cryptocurrency is volatile by nature. When you see the price suddenly go up or down, it’s normal to ask yourself why that happens.

The price of a cryptocurrency is influenced by many factors like supply, usage, vesting schedule and market sentiment. Due to its tokenomics, the STX token is inflationary, meaning the price is naturally trending downwards. Because tokens are being released over time this results in selling pressure from investors.

But that does not mean it can’t go up or down in price based on how much the Stacks blockchain is used. Usage is usually the key metric that influences the price of a token.

A negative event such as repeated delays or diminishing staking APYs can have broader implications for investors and result in the token price going down.

Positive events such as enabling Bitcoin NFTs or partnerships such as CityCoins using Stacks gives confidence to investors in the long run.

This brings more users to the Stacks ecosystem and usually has a positive impact on the price, making it go up. Other parts of the Stacks tokenomics can also influence the price, let’s see what those are.

A portion of a token’s supply is usually locked at launch, with the rest being slowly released in time. This can mean months, years or even decades — so it’s important to know the specific timeline of the chain you’re investing in. Such releases are mentioned in official documents such the Stacks roadmap or whitepaper.

Scheduled vesting unlocks and investors selling their newly unlocked tokens can put selling pressure on the token. This can make $STX — the fuel of the Stacks chain — go down in price temporarily.

However, as long as usage continues to grow that shouldn’t have too much of an impact in the long-term. The price of a coin is a complex number that stands on top of many pillars that are constantly changing.

Blockchains are resilient by design and have a couple of measures implemented at the protocol level to combat possible issues. This ensures the Stacks network can still function or in the worst case come back online at a later time, unaffected. Unless a catastrophic event occurs it’s impossible to pinpoint the price movement to one single cause.

Can STX reach $1 per token?

Buying and hodling STX — the native token of the Stacks chain — is one way of potentially making money on Stacks.

By looking at its current price, it’s natural to think about the chance of STX hitting $1 per token. This can happen sooner, or way in the future, and is determined by a couple of ever changing factors.

Let’s examine the potential growth of the STX token by analyzing its tokenomics. Stacks’s current market cap sits comfortably at ${MARKET_CAP}. With {CIRCULATING_SUPPLY} Stacks tokens being in circulation today, that means a price of {PRICE} per STX.

How did we come to that calculation? It’s quite easy, the price of a Stacks token is equal to its current market cap divided by the number of tokens in circulation. Dividing ${MARKET_CAP} by {CIRCULATING_SUPPLY} gives us a result of {PRICE} for each STX coin.

By changing the order in the simple formula above we can use it to calculate other things as well. This helps us a lot because we can deduce the market cap of Stacks at different token prices. Then, we can use the result to compare it to the current state of the network and see what would be required for Stacks to hit that price.

At a price of $1 per token, that means the current market cap of Stacks would equal ${{CIRCULATING_SUPPLY} * 1}. Remember that we arrived at this number by multiplying the amount of circulating tokens by $1.

Now let’s shift our attention to the fully diluted market cap.

Some blockchains may have their tokenomics built in a way that only a small percentage of tokens are circulating at the beginning. This can be misleading because we don’t have the full picture and only take into account the current number of coins released in the market.

The fully diluted market cap represents the total value of a coin if all tokens were in circulation. Stacks’s whole supply of tokens is {MAX_SUPPLY - TOTAL_SUPPLY + CIRCULATING_SUPPLY} STX which means that no more coins above that number will ever be created.

These tokens are not created at the discretion of a specific entity. They are created automatically by the network to reward different actors that keep it secure.

How does this impact the price of Stacks? Taking into account the current price of an STX token, that would result in a fully diluted market cap of ${MAX_SUPPLY - TOTAL_SUPPLY + CIRCULATING_SUPPLY * PRICE}. STX coins that have been burned are not taken into consideration because they have been permanently removed from circulation.

Whether it seems gigantic or not, the number we came to above only takes into account the current price of an STX token. Doing the same calculation but with a price of $1 gives us a result of ${{MAX_SUPPLY - TOTAL_SUPPLY + CIRCULATING_SUPPLY} * 1} for the Stacks network fully diluted market cap.

These are all crucial details to know when calculating if Stacks can reach the price of $1 per token. If the diluted market capitalization is way too high, the token has little room left to grow. Blockchains in general have no cap on the value they can reach, whether that number seems possible it’s totally up to you.

The future of Stacks depends solely on its growth as a network used by tens and hundreds of millions of users.

If you’re looking to add some Stacks (STX) to your portfolio, the most trusted places to get some are Binance and Coinbase.

Is Stacks (STX) dead?

If the price of a coin has stagnated for a long time, it’s healthy to ask yourself if the project has indeed died. Price, however, is not the only factor that should lead you to this assessment.

There are many other parts in the lifecycle of a blockchain that have to function properly for it to keep growing. Another important factor is the activity of the Stacks development team.

If the development team, or Stacks developers in general, have signaled the abandonment of the network that’s a bad sign for the Stacks ecosystem. Lower development activity on the Stacks network means fewer dapps being built.

A blockchain such as Stacks gets its users from the number of dapps released on it. They’re the primary motive to use a smart contract platform such as Stacks, without dapps there’s no incentive to use it.

The fewer dapps are available, the less users want to use the Stacks blockchain for their transactions. When more dapps get deployed, new use cases become available and more users join the Stacks (STX) ecosystem.

Currently, the Stacks (STX) blockchain is thriving both in dapps and development activity. This translates into a healthy ecosystem and new participants that join the network. With increased usage of the network comes more fees to validators, which are incentivized to spin up more nodes and further decentralize the network.

This cycle needs to always function smoothly to keep Stacks and its ecosystem alive. To asses the current status and future of a network we need to take a look at the latest updates and plans.

The biggest updates on the Stacks (STX) chain are the microblocks implementation and the launch of Stacks 2.0.

More updates are also prepared for Stacks, with the launch of Stacks 2.1 being the most important one.

You can keep up to date with developments in the Stacks ecosystem by following the most recent news that come out. The two main ways to do that is to periodically check all the Stacks (STX) specific web pages, or by following a central news source that posts updates as soon as they happen.

Even if the network growth starts to stagnate, knowing about it just a bit too late can make your whole investment worthless.