TL;DR: Buying FLOW and storing them is nice, but you’re leaving money on the table by doing that. The Flow network has a couple of ways you can participate in and earn extra revenue on your FLOW coins.

In this article, we’re gonna explore the best ways of putting your FLOW to work and what’s required to make sure everything functions properly.

How do you mine Flow (FLOW)?

So, you have a PC that’s sitting idle and you want to put it to work.

You’ve scoured the internet and saw that one of the ways to earn more crypto would be through mining, but how does that work? Can you mine Flow on your PC?

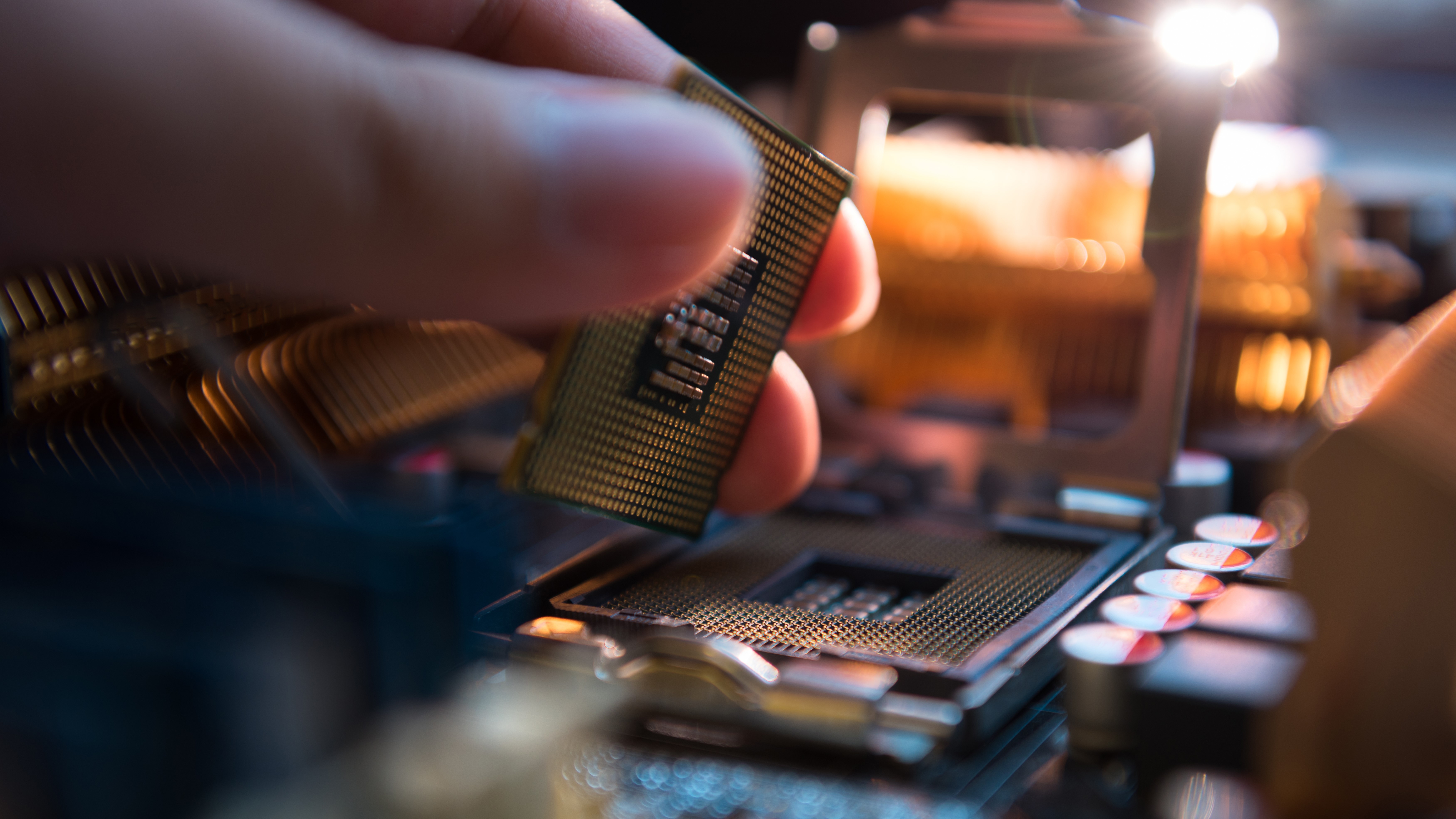

Mining is a process that can be done using different parts of your computer. These can be either the CPU, GPU or even your Hard Disk.

You heard that right, on networks such as Filecoin or Arweave your HDD is used to earn coins. What component is used for mining depends on the consensus mechanism of the specific chain.

The consensus mechanism dictates how transactions are validated on a blockchain such as Flow. Generally, the primary components used for mining are the CPU and the GPU.

The term CPU stands for “Central Processing Unit”. It is considered the brain of the computer because it does most of the computations. The GPU aka “Graphics Processing Unit” is more powerful than the CPU. This makes it more suitable for mining coins like Bitcoin or Litecoin.

How does mining work?

Mining is a process first implemented in Bitcoin’s Proof of Work consensus algorithm. During the first years, you could mine coins using a home computer or even a laptop. Today, that situation has changed.

Since its inception, mining has rapidly evolved and requires dedicated hardware that’s much powerful than a PC. As more computers join a network the hashrate increases, which means more processing power is needed to validate blocks. This is the case with the most known PoW chain — Bitcoin.

Because of this, miners have switched from using normal computers to highly specialized hardware called ASICs. ASIC is an abbreviated term and means “Application Specialized Integrated Circuit”.

This gives us little information about what they actually are, so let’s dig in. It may sound confusing at first, but the difference between a computer and an ASIC is quite simple.

A computer can do many different operations, but ASICs are built only for mining-specific computations. They are expensive, hard to configure, do not have a screen, and you can’t game on them.

That’s a bummer, so what does an ASIC actually do?

ASICs are noisy, ugly looking boxes that can only perform tasks for a specific chain based on the algorithm they were created for. The specific tasks we refer to are the ones necessary for mining blocks and getting coins. They are also power hungry and consume a lot of energy.

Take Bitmain's Antminer S19 Pro for example, considered to be the best mining rig currently on the market. What does it do? It sits there and makes you money, or Bitcoin to be specific.

In short, a Bitmain Antminer plugs into your wall socket and prints BTC by mining blocks. Buying such a behemoth will add 3.25 kWh to your electricity bill.

If you leave it running daily for 365 days one single device will consume around 28,470 kWh in a year. That’s triple the average annual electricity intake of an 🇺🇸 household. Now imagine thousands of machines running around the world and you get the electricity consumption of an entire country.

So you’re telling me that mining crypto consumes a lot of energy, but how much exactly? Well, it shouldn’t make you surprised to hear that the whole Bitcoin network consumes more energy than countries like Norway, Greece or Switzerland.

This is the reason why many Proof of Work blockchains such as Bitcoin and Litecoin have received backlash for their environmental impact.

Thankfully, the mining industry is integrating more renewable energy sources like wind, solar and hydroelectric. It is estimated that Bitcoin’s use of renewables range from about 40% to almost 75%. These numbers are expected to rise over the next years as renewable energy becomes cheaper.

On top of massive energy requirements, miners are faced with another challenge. ASICs have to be upgraded each year and they become obsolete very fast. The price for such mining devices starts from $2,000 and can easily reach $17,000 if you want the most powerful ASIC hardware.

Due to electricity costs it’s tough to remain profitable while mining, and even the best miners have trouble in that aspect.

Let’s get back to Flow and see how to make money on it. Is it possible to mine Flow on your computer?

Flow’s (FLOW) consensus mechanism is based on Proof of Stake. This is different from Proof of Work, where mining is used as the method for securing the chain.

Proof of Stake has validator nodes instead of miners, which do not mine but validate transactions. Validator nodes can run on almost any device and require much less processing power than their Proof of Work counterparts.

Because of this, energy consumption is also much lower on PoS chains — while maintaining the same security guarantees. On the Flow (FLOW) chain, blocks are created by validators who stake FLOW to secure the chain.

Validators run validator nodes, stake their FLOW coins and make sure their node stays online and does the validation work. Besides running a validator node, there’s also easier ways to stake Flow without having to set up your own infrastructure.

In conclusion, you cannot mine Flow because it is not a Proof of Work blockchain and no mining is done.

You can however stake FLOW tokens and become a validator or delegator, let’s see how that works!

How to stake Flow (FLOW)?

We’re now getting to the good part, making money by staking your FLOW tokens.

FLOW staking can be done in a few different ways. Each method has its own advantages based on your specific needs. Let’s explore what a staking node is, how Flow can be staked at home, and what a staking provider is.

Staking Flow yourself is a tedious process that involves a few different steps. In order to stake Flow (FLOW) first you have to set up a validator node. Some online resources refer to validator nodes as staking nodes, they’re the same thing.

In plain terms a validator node is a program that runs on a computer, either locally or in the cloud. As their name suggests, validator nodes keep the network secure by validating transactions. For their service, validators receive a reward in FLOW tokens.

The most important steps for setting up a Flow node at home are: setting up the software, connecting it to the network, and securing your keys. This has a lot of potential for mistakes and can result in your tokens being stolen or lost forever.

To use your FLOW for validating transactions on the Flow network, you need to lock them as a guarantee. This “guarantee” (aka stake) exists to make sure Flow validators act in good faith and only mine valid transactions.

The process of running a validator node by yourself is not an easy one for multiple reasons. Staking Flow also requires your node to be online at all times, otherwise you will get penalized and lose part of your staked tokens (also known as slashing).

Validators that go offline or try to attack the network have a portion of their staked tokens taken away. As noted before this mechanism is called “slashing” and it’s a term used in all Proof of Stake blockchains.

On chains such as Flow, slashing is the primary way of making sure validators act honestly. Slashing is an action done by the network itself, no single person or validator can decide to slash another validator.

For most users setting up a Flow validator node is costly. In the case of FLOW a node needs approval from the team in order to validate transactions. While running a validator node, tokens are locked (staked) and cannot be transferred.

Unlocking the FLOW tokens has a cooldown period of 14 days. After 14 days validators can withdraw their FLOW coins to their wallet. You may want your FLOW tokens to be easily accessible in the event of a crash or market pump. In this case, staking with a provider is the best option as the cooldown period is very small or 0.

So, if you’re looking to set up a node at home always keep in mind that your stake is locked and cannot be withdrawn until the cooldown period has ended.

Even with some drawbacks, setting up a validator node at home is beneficial for the network and promotes decentralization. However, do not forget that you need to make sure your node is always up to date and online. Missing an update or having your connection go down for a longer period or time will result in slashing (losing tokens).

Staking at home should only be done by experienced users that can keep an eye on their staking software at all times. The most up to date resources for staking Flow at home can be found at Flow's documentation and on YouTube.

Staking your FLOW at home is not for everyone — fortunately it’s not the only way of earning more Flow tokens.

If you do not wish to go through the hassle of setting up and configuring a Flow node we have good news for you — there’s a couple of easier ways to do it! Some websites, also called staking providers, offer a service called “staking as a service”.

Staking as a service means you can stake your FLOW tokens without setting up a server or node. Staking providers operate the infrastructure needed for staking Flow and receive a small portion of the FLOW reward.

There’s no fee for staking on an exchange, the provider/exchange only takes a very small cut from the profit. If you’re looking to stake with a provider, there’s a few places where you can stake Flow (FLOW) in a safe way.

Currently, the most trusted places to stake Flow (FLOW) are MyCointainer and Binance.

Exchanges, especially major exchanges like the ones mentioned above have an insurance policy to protect user’s funds in case of hacks or other events. Both exchanges provide an APY between 10% and 12% for staking your FLOW tokens with them.

To stake Flow on MyCointainer or Binance you only need to create an account and deposit your coins.

Staking on an exchange is the best solution if you want the process to be easy and safe.

Where to stake Flow (FLOW) — A Comparison

Stake FLOW at Home (Hard)

Drawbacks: Hardest. Prone to failure and losing tokens.

Benefits: Most decentralized.

Join a Flow Staking Pool (Moderate)

The biggest Flow staking pools are Stakefish and Coinlist.

Founded in 2019, Stakefish is a globally distributed team that offers staking for various cryptocurrencies. Thanks to their distributed model, the team is able to guarantee 100% run time for nodes. The APY for staking FLOW is around 13%.

CoinList supports staking through CoinList wallets. CoinList partners with Bison Trails to provide staking services to users. On the good side, if you deposit FLOW into your CoinList wallet, you will automatically be enrolled in FLOW staking. The APY for staking FLOW is around 4.6%.

Drawbacks: Moderate difficulty. Takes time to unlock your tokens.

Benefits: A good balance between simplicity and decentralization.

Flow Staking as a Service (Easy)

Drawbacks: Funds are delegated to an operator.

Benefits: Easiest. Instant token unlock.

Flow Staking FAQ

How can I stake Flow (FLOW) tokens?

Staking Flow can be done by running a node, joining a pool, or using a staking service.

Can you stake Flow (FLOW) on Coinbase?

No, staking Flow is not supported on Coinbase.

However, other exchanges such as MyCointainer and Binance offer seamless FLOW staking services.

Can you stake Flow (FLOW) on Kraken?

Yes, Kraken does offer staking as a service for Flow.

If you are already using Kraken as your main exchange it’s a good idea to stake your Flow there too.

Otherwise, other exchanges such as MyCointainer or Binance usually have a better APY and service for staking Flow.

Can you stake Flow (FLOW) on Binance?

Yes, Binance does offer staking as a service for Flow.

Staking FLOW on Binance is as easy as creating an account and depositing your Flow tokens.

Can you stake Flow (FLOW) on Kucoin?

No, staking Flow is not supported on Kucoin.

However, other exchanges such as MyCointainer and Binance offer seamless FLOW staking services.

Can you stake Flow (FLOW) on Robinhood?

No, staking Flow is not supported on Robinhood.

However, other exchanges such as MyCointainer and Binance offer seamless FLOW staking services.