We both know that Uniswap pools can be a potential goldmine, but if you've aped in a new pool in the past only to end up being exit liquidity then you've (finally) stumbled on the right place.

For one to take advantage of the potential gains on being early, you must be among the first and already prepared.

The rest? Exit liquidity.

"Just check DexTools for new pairs bro"

Yeah good luck:

Scanning thousands of pools

Missing early gems

Finding rugs too late

Being slower than bots

Or... automate like smart money 👇

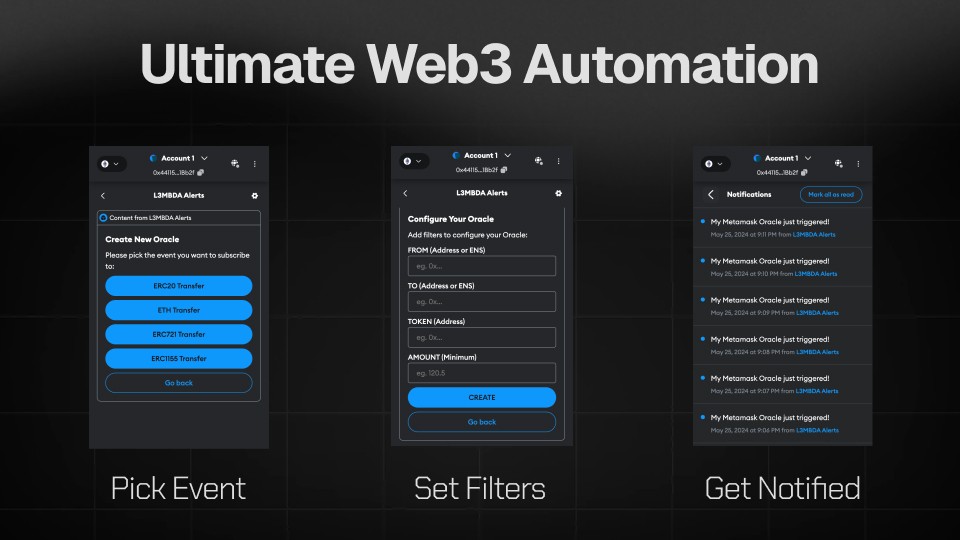

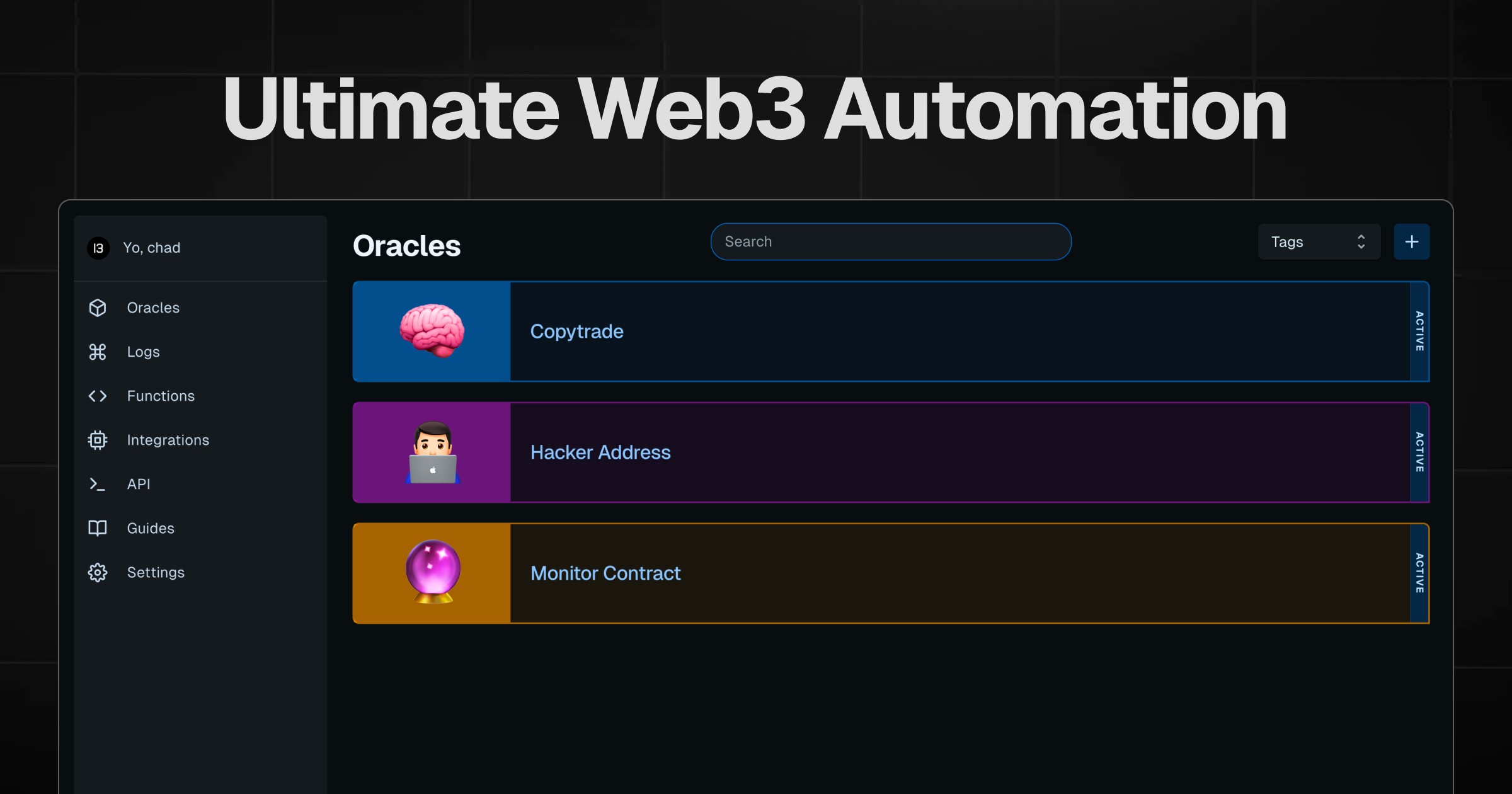

Ultimate Web3 Automation

L3MBDA's killer feature is 👀 Oracles.

They're extensible and you control them just with a UI. They can be used for sending Telegram, Slack, Email alerts and more, to running your custom code.

Best part? It's free to join and you can also integrate with Pipedream, Zapier, Make, N8N or our API.

Step 1 & only — Uniswap Pool alerts

Download the L3MBDA iOS app for free on the App Store.

Create a new Oracle, and choose "Liquidity +/-" as the event.

Select “Push” as the action, but you can also run on device Shortcuts.

Set liquidity thresholds and filters.

Now you're actually early.

Tracking Pools on Uniswap

Now that we get alerted instantly when new pools appear, here are key opportunities to watch for:

First mover advantage on early token pairs

Initial liquidity concentration levels indicating project confidence

Unusual pool parameters that could signal innovative mechanisms

Cross-protocol arbitrage opportunities right at launch

Pre-configured slippage settings suggesting team experience

That's all…

…but if you're looking for more Push web3 automations, check out: