TL;DR: With a new update or project being released almost every day, it’s clear the crypto ecosystem is constantly evolving. Optimism has gone through a lot of ups and downs to reach the level it’s at today — but it’s just the beginning. Knowing what brought it here and why it was created will lead you to make better decisions when investing or simply using Optimism.

In this article, we’re gonna dive into the Optimism ecosystem, answer all the $OP related questions and even more. Prepare yourself for a history lesson and a journey to the future of Optimism!

What is Optimism (OP)?

Optimism is a Layer 2 scaling solution created in 2019 by a team of Ethereum researchers. The protocol leverages the security of Ethereum and enables the much-needed scalability of the network. Scalability is defined as the amount of transactions that Ethereum can process per second, or throughput. Currently, Ethereum currently processes about 17 TPS. This is because Ethereum chose to prioritize decentralization and security over scalability.

Research has led to the conclusion that every blockchain has to make a tradeoff between decentralization, security and scalability. This problem has been coined as the “blockchain trilemma.” Each blockchain that has emerged since then had its architecture influenced more or less by the blockchain trilemma. Some networks traded decentralization to achieve security and scalability, while others traded security to achieve decentralization and scalability. Ethereum chose to trade scalability for decentralization and security.

Every blockchain strives to incorporate all these three aspects into its design. Ethereum was the first network to tackle scaling from a multi-faceted perspective. Led by Vitalik, the research team has come up with two general ways of scaling: on-chain and off-chain.

On-chain scaling keeps all the transactions at the base Ethereum chain. The approach is to increase the throughput of the base chain itself. It is generally considered that on-chain scaling provides better security guarantees because. This is because security measures are implemented on one layer, removing complexity along the way. The most popular on-chain scaling technique is called sharding, which is seen as still in the experimental phase.

The concept of sharding has been first introduced by Ethereum in 2015. Sharding is a process in which the whole blockchain is split into smaller blockchains aka shards. Because each shard contains its own data, it makes it unique and independent from other shards. As a result, each shard can separately process more data.

Using this innovative method, blockchains can process exponentially more transactions without compromising data availability. Recently, more projects have focused their attention on sharding, each with its own implementation.

By contrast, off-chain scaling separates the computational layer from the base layer. Put simply, transactions are processed off-chain and the proof is posted on the main chain. Layer 2 or off-chain scaling solutions are broadly divided into: State Channels, and Sidechains.

Ethereum is the only chain benefitting from both types of scaling. Sharding is currently being implemented by the Ethereum Foundation. Until sharding is fully implemented, projects such as Optimism, Arbitrum, Polygon and StarkNet took on the challenge of implementing off-chain solutions. As a result, Ethereum is scalable in the short-term, and ultra-scalable in the long-term.

Optimism, as the name implies, is an Optimistic Rollup. Its name stems from the way blocks are verified before they are submitted to the Ethereum main chain. Optimism starts from the premise that participants are honest about the validity of their transactions. Their transaction is considered pending for a 7-day period, called the challenge window. If the transaction gets unchallenged, then it is considered final. Once a commitment is considered final, smart contracts on Ethereum can safely accept proof of the state of Optimism based on that commitment.

When a transaction is challenged, it can be invalidated through a "fault-proof” process. If someone indeed tried to lie about their transaction, then their transaction is removed. It's important to note that a successful challenge does not roll back Optimism itself, only the published transaction.

The protocol is designed so that users can communicate between smart contracts on Optimism and Ethereum. This makes it possible to transfer assets, including ERC20 tokens and NFTs, between the two networks. The exact mechanism by which this communication occurs differs depending on the direction in which messages are being sent.

Ethereum has introduced the concept of smart contracts. These are small applications that run inside a virtual machine called the Ethereum Virtual Machine. The EVM allows for a blockchain to process more than simple token transfers. To give more info, it opened up the possibility of running applications in a decentralized manner.

Applications usually run in the cloud or on your computer, so running them on a blockchain was unheard of at the time. This makes them uncensorable (nobody can stop them) and ensures they’re always online — as long as the chain they run on is processing transactions. Optimism is based on the same EVM architecture created by and used in Ethereum. It does, however, use a different architecture in order to make it easy to deploy dapps on Optimism, and it's called Optimistic Virtual Machine, or OVM.

The Optimistic Virtual Machine (OVM) is the operating environment for smart contracts within an optimistic rollup. The OVM plays a pivotal role, enabling developers to run decentralized applications on L2 rollups seamlessly, preserving the user experience akin to Ethereum.

Virtual machines, acting as state machines, can transition between states based on inputs. In blockchain systems, the consensus protocol governs these transitions. For instance, Ethereum's state transitions adhere to rules defined by the EVM and enforced by its proof-of-work (PoW) consensus.

The OVM operates on an "optimistic execution" model, not initially validating state transitions, which enhances efficiency compared to layer 1 (L1) blockchains like Ethereum, where consensus on transition validity can slow processing.

To ensure security, OVM allows anyone to challenge state transition validity, with the L1 chain acting as the adjudicator, employing "fraud proofs" in this process.

Being Turing-complete, the OVM can execute a wide range of tasks, making it versatile for various smart contract applications. It operates on a layer 2 blockchain, an extension of the parent chain (like Ethereum), where the L1 chain guarantees the correctness of state transitions and the availability of execution data in the L2 OVM.

Optimism is powered by the OP token, a central part of the Optimism ecosystem.

OP is an inflationary token due to the way its tokenomics have been planned. This means that new OP coins are created with each block and the the circulating supply expands. Furthermore, the OP token holders get to decide the emission schedule for new OP tokens.

The Optimism inflation rate sits currently at around 2% per year. Optimism has a maximum supply of 4,294,967,296 OP.

For more details about how you can earn more Optimism by running a validator node at home check out our Optimism Mining & Staking guide. It includes the exact steps and best methods of earning more crypto like $OP in 2024 and beyond.

When was Optimism (OP) created?

Optimism (OP) was created during a series of research projects into scaling solutions for Ethereum. Work began on the Optimism chain in 2018, but before that, a couple of important events happened. Most events revolve around the emergence of layer 2 solutions for Ethereum.

The first meaningful event is a paper released by Vitalik Buterin and Joseph Poon with the title “Plasma: Scalable Autonomous Smart Contracts.” Released on August 11, 2017, it proposed a framework for scaling the amount of transactions that can be processed on a blockchain.

According to Vitalik, it is a bad idea to build sophisticated features into the base layer of a blockchain. It would create a lot of complexity as the community would have to continually discuss, implement and coordinate newly discovered technical improvements. Such a time intensive activity might cause Ethereum to stagnate. His idea was to keep the layer 1 blockchain stable, and layer 2 will take the burden of carrying the innovation and change.

The term “side chain” was first used to describe the child chains in Plasma. These side chains report periodically to the main chain and use it to settle disputes. Plasma qualifies as an off-chain solution, which is different from doing the computation on the main blockchain. To relieve the main blockchain from the burden of computation, the activity is done on the child chain, and the proof is later submitted on the main chain.

The Plasma structure is built out of smart contracts and cryptographic verifications, enabling the creation of an unlimited number of smaller chains, called child chains, which are essentially smaller copies of the parent Ethereum blockchain. This means that the child chains could coexist and operate independently. Eventually, Plasma would make it possible for businesses to implement scaling solutions in various ways, according to their needs.

Plasma was promising scalability to the level of Visa transaction volumes. In the midst of the 2017 bull run, Ethereum network was struggling to keep up with the demand. Their community was still the biggest in the crypto space, but even the diehard fans couldn’t afford to pay $100 for the transaction fees.

The paper on Plasma led to instant excitement from the Ethereum community, who had the chance to experiment and implement the concept. A group of core Ethereum researchers took up the challenge of building out the vision, and this is how Plasma Group was born.

Another meaningful event was Plasma Group’s pivot to the Optimistic Rollup.

Development on the initial Plasma implementation had been going on for two years, but in 2019 it was stalled. Plasma made big promises about its security and scalability. But as the bear market kicked in, a more realistic picture of Plasma began to crystalize. When it came to the actual deployment, Plasma had more problems than solutions.

The first problem was that each user had to keep his eyes on the Plasma chain to detect any malicious behavior and exit if needed. This monitor requirement already posed a significant overhead for the user.

The second problem was that it was difficult to exit the Plasma chain. When a user submits an exit transaction, he has to wait a certain period of time. This is known as the challenge period. During this window of time, anyone can challenge another user’s exit by providing proof that the exit is invalid. Thus all exits can be processed only after the challenge period is over.

These were only a couple of the issues that Plasma was dealing with. In 2018, Vitalik conceptualized a new version called Plasma Cash. Under the improved iteration, all assets are implemented as NFTs. Simply put, users are responsible for proving ownership over their own coins and no one else’s. As a result, users only need to monitor their own assets and not the entire Plasma chain.

However, Plasma Chain introduced a new set of challenges. Namely, users had to remain online at least two weeks while the challenge period lasted. Additionally, users had to maintain the entire transaction history to prove they own the asset, leading to rising storage requirements.

Just as the confidence in layer-2 was at an all-time low, a GitHub repo named “roll_up” was made public by a pseudonymous user known as Barry Whitehat. This repo described a new type of layer-2 scaling solution: a Plasma-like construction with “bundled” up transactions, where instead of relying on operator trust, the correctness of the bundle could be attested to using an on-chain proof — a SNARK.

This SNARK ensures it is impossible for an operator to post malicious or invalid transactions, and guarantees that all sidechain blocks are valid. Soon after, Vitalik released an improved version of Barry’s proposal he termed zk-Rollup.

After a few more iterations, developers found a way to verify Ethereum transactions off-chain without any fancy zero-knowledge cryptography. Starting from this version, the Plasma Group released an extended design with the now well-known title: Optimistic Rollup.

Who created Optimism (OP)?

Optimism was created by Jinglan Wang and Kevin Ho together with several dedicated Ethereum researchers.

Jinglan Wang is a computer scientist born in China. She is the Executive Director of the Blockchain Education Network, and now works full time at Optimism. Her first contact with crypto was in 2017. She joined Wirex a few months later as the Community Manager. During her stay at Wirex she was in charge of creating educational content, as well as building a thriving community.

She started learning more about crypto at the MIT Bitcoin Club, and since then has been a blockchain product manager at Nasdaq and co-founded the trade financing startup Eximchain.

One of her most important projects was co-founding the Blockchain Education Network (BEN), a community created to bring students and alumni together from all over the world to educate, nurture and flourish in the blockchain space.

Since 2018, she has been involved in Optimism, of which she is the CEO. The other co-founder is Kevin Ho, who serves as the Protocol Product Manager at OP Labs. Kevin Ho studied at the University of Pennsylvania between 2014 and 2018, where he graduated with a Bachelor’s degree in Computer Science: Digital Media Design.

Kevin Ho started his career working at Cryptoeconomics.study, a free, open-source blockchain protocol course. After one year, he co-founded Plasma Group together with Jinglan Wang, which has since rebranded to Optimism.

Other important contributors are Plasma’s lead researchers: Karl Floersch and Ben Jones. Both have been previously working at the Ethereum Foundation and the now serve as the CTO, respectively Chief Scientist.

How is the Optimism (OP) token used?

The Optimism token is the native token for the Optimism network. Since Optimism isn’t a blockchain, but a scaling solution, its token has a different purpose than for paying transactions. Transaction fees are being paid in ETH.

The OP token is used for governance. The OP token holders are part of a bicameral system where OP token holders form a body to vote on certain governance matters.

Its second utility is to serve as the de-facto asset for ecosystem funding. OP tokens have been airdropped to users and protocols which supported the Optimism ecosystem, and will be distributed through the OP Governance Fund to future projects building on Optimism.

Optimism is currently listed on multiple exchanges. The major ones are Binance, Coinbase and Kraken.

If you want to skip ahead and learn how to earn more Optimism by running a validator node at home check out our Optimism Mining & Staking guide. It includes the exact steps and best methods of earning more crypto like $OP in 2024 and beyond.

Who is developing Optimism (OP) now?

Development on Optimism started in 2019 by a team who later spun out into OP Labs.

After validating their idea, the team of researchers at Ethereum established Plasma Group as a non-profit company. But after a series of dead ends and lack of funding, they’ve decided to abandon studying Plasma scalability, and instead focus on implementing Optimistic Rollups.

This change in direction called for a rebrand from Plasma Group to Optimism. In order to deliver the new scaling solution, OP Labs became a for-profit organization. Besides handling the development of the core protocol, it is also tasked with seeding an ecosystem of projects and infrastructure that drives the global adoption of Ethereum.

Parts of the codebase was written by external developers, making open source contributors the primary driver for where Optimism is today. The majority of open source contributors are from the Ethereum community.

Open source contributors can access the protocol’s code on GitHub where they can find resources for optimism project ideas, a detailed tutorial and every single technical documentation.

An integral part of the Optimism governance revolves around the formation of the Optimism Collective, serving as an extensive experiment in digital democratic governance. This initiative is pivotal in steering the rapid and sustainable growth of a decentralized ecosystem. At the helm is the recently established Optimism Foundation, playing a crucial role in stewarding this endeavor.-

Within this collective, communities, companies, and individuals unite under a mutually advantageous pact, emphasizing the fundamental axiom that impact equals profit. This concept is profoundly elucidated in the Optimistic Vision.

The governance structure of the Optimism Collective is bifurcated into two houses of equal influence: the Citizens’ House and the Token House.

The Token House is brought to fruition through Airdrop #1, welcoming the initial cohort of engaged individuals who champion community-oriented actions resulting in a positive-sum outcome. Token holders, identifiable through the OP token, hold the authority to partake in vital decisions such as protocol upgrades, project incentives through the Governance Fund, and other significant matters.

Conversely, the Citizens’ House is responsible for orchestrating and supervising the distribution of retroactive public goods funding, generated from the network's revenue. Citizenship is conferred through "soulbound" non-transferrable NFTs, and the number of citizens expands as the Optimism community grows. This house essentially shifts power dynamics away from centralized entities, adhering to a human-centric, non-plutocratic mechanism.

The collaboration of these two houses is instrumental in channeling the revenue generated from the OP Mainnet into initiatives that foster public goods and contribute to the collective's growth. More detailed insights into this structure can be gleaned from the Governance Overview.

This bicameral governance system is meticulously designed to avoid the governance pitfalls experienced by other models within Ethereum today. The chapter delves deeper into whether this governance is on-chain or off-chain and highlights that while governance lessons are still being learned, the current structure remains flexible and open to evolution. It also recognizes the role of the Optimism Foundation in conducting governance experiments and kickstarting the ecosystem, underlining its significance in the path towards decentralization.

In essence, the Optimism Foundation emerges as a new entity dedicated to governance experimentation and nurturing ecosystem growth. It will be spearheaded by two of the Optimism founders, Jing (formerly CEO) and Ben Jones (formerly Chief Scientist). Joining them are fresh faces: Eva Beylin, Executive Director of The Graph Foundation, Abbey Titcomb, Council Member of the Radicle Foundation, and Brian Avello, former General Counsel to the Maker Foundation.

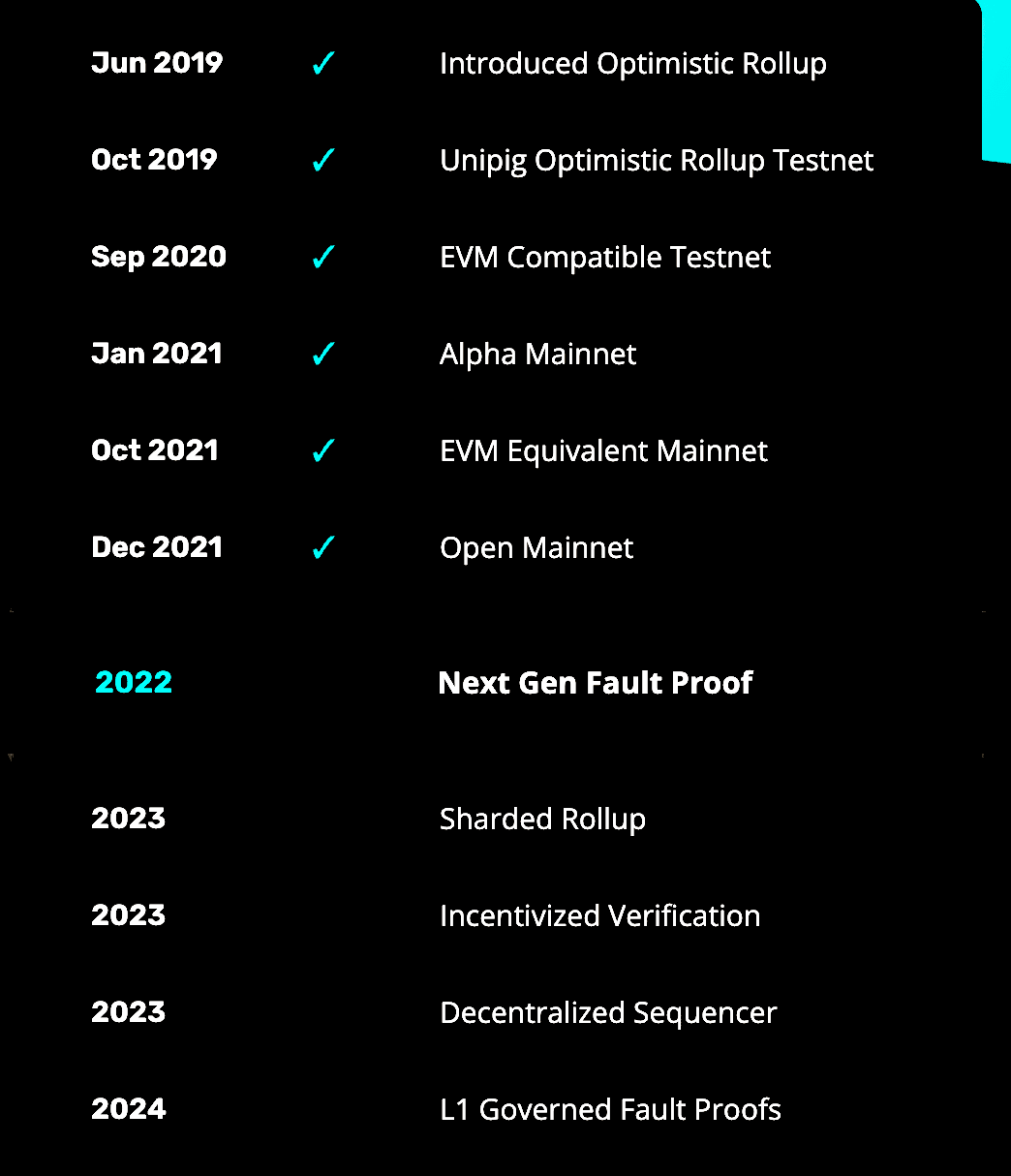

What are the latest updates on Optimism (OP)?

Optimism in 2019

2019 was Optimism’s launch year. Launched initially as Plasma Group, the team announced a full service plasma toolbox for deploying, transacting on, building with, and developing on plasma chains.

Following a series of failed Plasma experiments, the team developed a version conceptualized by Vitalik. Plasma Cash draws from the developments within the research community. One of the most important improvements Plasma Cash introduced was “light proofs.” Previously, plasma constructions required that users download the entire plasma chain to ensure safety of their funds. With Plasma Cash, they only have to download the branches of a Merkle tree relevant to their own funds.

The implementation was still in beta. Plasma Group made available the documentation and invited the community to test out Plasma Cash. Moving forward, they had to implement a user friendly interface for testing. One month later, the team devised a new architecture for building plasma apps, called plapps. This was an open invitation for developers to chime in and implement their dapps on Plasma.

The core idea behind layer-2 is that developers can use data outside the blockchain (off-chain) to provide guarantees for an asset sitting on the main chain (on-chain data). For example, that off-chain data might give you the right to withdraw an asset held in an on-chain escrow contract on Ethereum. But the ownership of that asset changed hands without touching Ethereum. However, the road from the concept to the actual service was more difficult than meets the eye.

Over the course of the year, Plasma Group concretized its research into a more viable concept called Optimistic Virtual Machine (OVM). Its goal was to unify all scalability solutions (plasma, lightning) under a single virtual machine: the OVM. From that point on, the team was on the path to transition from Plasma to a more general approach towards scaling: Optimistic Rollups.

Optimism in 2020

In 2020, Plasma group has abandoned Plasma research and chose to focus instead on public goods. While acknowledging that scalability is still a high priority, the researchers identified the funding of public goods such as open-source software as a key challenge.

The Plasma Group announced that they would donate the remaining funding to Gitcoin, as they would start from scratch as a for-profit organization.

On January 15, Optimism laid out Optimistic Rollups – a scaling solution that enables instant transactions on Ethereum. The backbone of their implementation is the Optimistic Virtual Machine (OVM), which is fully compatible with the EVM.

Users were able to experience it for themselves by playing UniPig, a gamified proof of concept in collaboration with Uniswap. The ongoing focus was on creating a universal capability to execute any Ethereum contract in the OVM without the need for custom code.

Shortly after, Optimism released the alpha version of the Optimistic Virtual Machine (OVM). In a nutshell, the OVM supports Ethereum smart contracts exactly as they appear on Layer 1. In case of invalid state transitions in the OVM, the protocol allows users to post fraud proofs and revert the fraudulent transaction.

As they ventured into the L2 rabbit hole, a turning point arrived with the completion of the UniPig demo. It was a lightbulb moment, making them realize the need to take this demo to the next level and make it ready for wider use. But transforming it into a secure, production-ready code required a lot more resources than they could gather through donations alone. Many in the blockchain community faced this same challenge: how to get the funding needed to develop important tools and technologies, beyond relying on individuals' generosity and donations?

They saw Layer 2 as a game-changer to tackle this problem. It was an opportunity to rethink how the blockchain network operates economically, ensuring that the value created by the network could be reinvested to support and expand it.

In simple terms, just like miners in Ethereum make money from fees and rewards, they also have the power to decide the order in which transactions are processed. This power extends to layer 2 block producers too. They came up with a clever way to take some of that value and put it back into the ecosystem. They detailed the nitty-gritty of this proposed model in a document called “Auctioning transaction ordering rights as a solution to MEV”.

To kickstart this growing ecosystem and develop the necessary software, they secured a funding of $3.5 million from Paradigm and IDEO CoLab Ventures.

Over the course of the year, Optimism’s L2 had been integrated with Coinbase Wallet and they even launched an OVM testnet with Synthetix, a synthetic asset issuance protocol. Their focus was twofold: improving the underlying transaction mechanism and tailoring a user-friendly interface.

Optimism in 2021

2021 was Optimism’s launch of the so-called soft mainnet. When they made their platform available to users, they called it a "soft launch" because it wasn't the typical big, final launch. It was more like a practice round. Much like they did during the test phase, they started with a basic version, adding what they called "training wheels" to guide the initial use.

More specifically, these training wheels included a whitelist for entities deploying on Optimism, a manual checklist for pending withdrawals, and the use of admin keys. It wasn’t nearly as decentralized as the community had hoped, but it was a safe route to gradually decentralized the protocol in a safe manner.

On July 13, Optimism made headlines after Uniswap V3 announced they would be the first major protocol to deploy on Optimism. This release was, however, capped to 50,000 transactions per day and the prospect of downtime.

By the end of the year, Optimism had lifted the whitelist, which enabled any developer to deploy their dapp on Optimism. This new development along with the incremental OVM improvements has catapulted the Optimism TVL to $257M overnight.

Another breaking announcement was Optimism’s roadmap for retroactive public goods funding. Using the earnings generated from their protocol, funding from past activities, and leveraging a Results Oracle, they aimed to establish a funding cycle reminiscent of startup funding but for projects benefitting the public good.

The team at Optimism expressed their dedication to directing all profits generated through their sequencing efforts (before achieving decentralization of the sequencer) towards experimental funding for public goods. Even though they hadn't generated profits for grants at that point and were still refining the specifics, they were eager to make this promise and outline the core concepts of their initial experiment.

The core principle guiding retroactive public goods funding is the acknowledgment that it's simpler to reach a consensus on what has been useful than to predict what will be useful in the future. While even determining past utility can sometimes be a point of contention, existing voting mechanisms like quadratic voting or regular voting can provide reasonable top-level judgments. However, predicting future usefulness is significantly more challenging. In the profit-making sector, the approach involves creating an ecosystem where people can establish startups, invest in them, and receive rewards if their predictions turn out to be correct. Instead of completely reinventing this wheel, the aim is to devise a version of the same mechanism with a public goods focus.

This version involves a DAO termed "the Results Oracle" that funds public good projects. The long-term plan is for the Results Oracle to be funded by protocol fees, with sequencer auctions being one potential candidate, especially if implemented by an L2 project. Diverging from other public goods funding DAOs, the Results Oracle allocates funds retroactively, recognizing and rewarding projects that have already contributed value.

Designing this oracle poses a significant challenge, especially when considering known issues with simplistic approaches such as coin voting. An iterative approach is deemed best, starting with a simple early version that could comprise around 20-50 technically skilled long-time contributors from the implementing ecosystem. This scheme's refinement can occur over time as understanding of decentralized governance deepens.

The Results Oracle has the capability to send rewards to various types of addresses. This could include a single individual or organization chiefly responsible for driving the project, a smart contract representing a fixed allocation table dividing funds among multiple contributors, or a project token distributed to individuals and/or organizations based on their contributions, tradable within the ecosystem.

Project tokens represent a more radical concept, essentially forming a prediction market for what the Results Oracle will fund. This allows the oracle to set a price floor for the token using its funds, essentially rewarding the project multiple times. Additionally, a project token could receive rewards from other sources like NFT-like collectible value or the project’s own economic model if it develops one. Disagreements on contribution levels within a project may lead to multiple competing allocation tables or project tokens, necessitating the Results Oracle to determine the most appropriate measure of contributions in such cases, albeit ideally in exceptional circumstances only.

Optimism in 2022

2022 has been a monumental in terms of recognition for Optimism. The L2 had cut Ethereum gas fees by 30% and saved users more than $1 billion in fees. It was a moment when power users were already feeling comfortable using L2s and all the effort from the previous years paid off.

Optimism was ready to take things to the next level, which meant more money, and more brain power to decentralize the network.

With a series B fundraise of $150 million, Optimism gained the necessary funding to continue its vision. The team had a rejuvenating speech for the Ethereum community: early cooperators who provide public goods will be rewarded in kind. Hence, Optimism committed 100% of the protocol fees towards incentivizing open-source contributors on Optimism.

More importantly, on June 1st, the OP token was launched along with a resounding airdrop for the OP community. It was a moment of joy, where early OP users were reaping the rewards of participating on the network. In total, 248,699 addresses are eligible to claim OP in the first airdrop round.

In the wake of unveiling the Optimism Collective, a two-phase incentive program known as OP Stimpack was announced, earmarking 231,928,234 OP (5.4% of the initial supply) to fuel growth within the digital realm of Optimism. This program, crafted to spur both existing and new developers, aimed to establish a robust presence in this promising digital landscape.

By that time, nearly 30 Phase 0 proposals had been submitted, and the opening of Phase 1 proposals was imminent. These proposals represented the inaugural vote of the Token House, with incentives set to be allocated to projects in the upcoming weeks and months.

In a recent development, the inaugural Operating Manual of the Optimism Collective was released. This manual served as a comprehensive guide detailing how the Collective formulated and executed decisions. In line with their progressive governance approach, this manual was a living document, having already undergone upgrades based on valuable community input!

On October 18, Optimism has unveiled the next evolution of Optimism’s scalability architecture: the OP Stack.

The OP Stack represented a modular, open-source blueprint designed for creating highly scalable and interoperable blockchains across various paradigms. It transcended the confines of just rollup or optimistic solutions.

This initiative had faith in the collective ingenuity of the Ethereum community. It simplified the process of building one's own blockchain, allowing individuals to concentrate on pushing the boundaries of technology.

Moreover, the OP Stack placed a wager on a future that wasn't confined to being either multi-chain or mono-chain. Instead, it envisioned a collective of tightly integrated chains forming an emergent structure—the Superchain—which would drive the collective forward.

Optimism in 2023

The current year has been the best year of Optimism, with the price of $OP reaching an ATH of $4.57. This was heavily influenced by two factors.

The biggest announcement by far was Coinbase joining Optimism as an L2, called Base. Not only that, but Optimism has laid out the thesis for Superchains – a mesh of L2s integrated into a single interoperable and composable system.

In the present, Coinbase, as a core developer, is actively collaborating with OP Labs to advance the mission of the Optimism Collective, solidifying the OP Stack’s position as a highly influential public good within the ecosystem.

Functioning as a blockchain, Base is dedicated to contributing a portion of transaction fee revenue to the Optimism Collective treasury, aligning with the vision for a sustainable future where Impact equals Profit.

In the immediate future, this collaboration aims to enhance OP Mainnet, Base, and other Layer 2 solutions by implementing an initial Superchain structure, integrating shared bridging and sequencing.

Over time, the Superchain has the potential to evolve into a vast network that optimizes interoperability, distributes decentralized protocols, and standardizes its fundamental elements—all while actively funding the public goods that empower its growth.

Looking ahead, the Superchain has the potential to evolve into an extensive network that prioritizes interoperability, shares decentralized protocols, and standardizes fundamental elements—all while actively supporting public goods that are essential to its growth

The vision for a Superchain structure was further detailed in the “Law of Chains”, the foundation for defining an MVP of the Superchain.

In the present day, each new OP Stack chain navigates its own frontier without a straightforward way to share standards and improvements. Meanwhile, users and builders face an overwhelming challenge: individually evaluating numerous different chains on the basis of security, quality, and neutrality.

To realize the Superchain, one needs to move from OP Stack chains as independent and disparate blockspaces to a unified collective of chains that uphold a shared commitment to open, decentralized blockspace. The goal is a world where problems only have to be solved once, improvements benefit everyone, and users aren’t overwhelmed.

The Law of Chains creates guiding principles for Optimism Governance and the Superchain. Optimism Governance moves from governing a single chain to governing a standard shared by many chains, thus defining the properties that are required to be a part of the Superchain while prioritizing the protection of users as they traverse and transact within it.

First, the Law of Chains enumerates various categories of stakeholders across the ecosystem. Then, it defines the protections and expectations that should apply to those participants and the values that should be upheld when making decisions which affect them. It's not a definitive voting process or procedural playbook for Optimism Governance, but an enduring neutrality framework to be upheld amid evolving specifics.

As an MIT-licensed public good, individuals have the right to use the OP Stack however they see fit. The Law of Chains will only apply to OP Chains that opt-in to become part of the Superchain, providing a value proposition for those who want to play the positive sum game.

Optimism is in a constant growth cycle, and network participants like us can earn more $OP without too much hassle or technical knowledge, right from the comfort of our homes.

Learn how to do that in our Optimism Mining & Staking guide, which includes the exact steps and best methods of earning more crypto like $OP in 2024 and beyond.